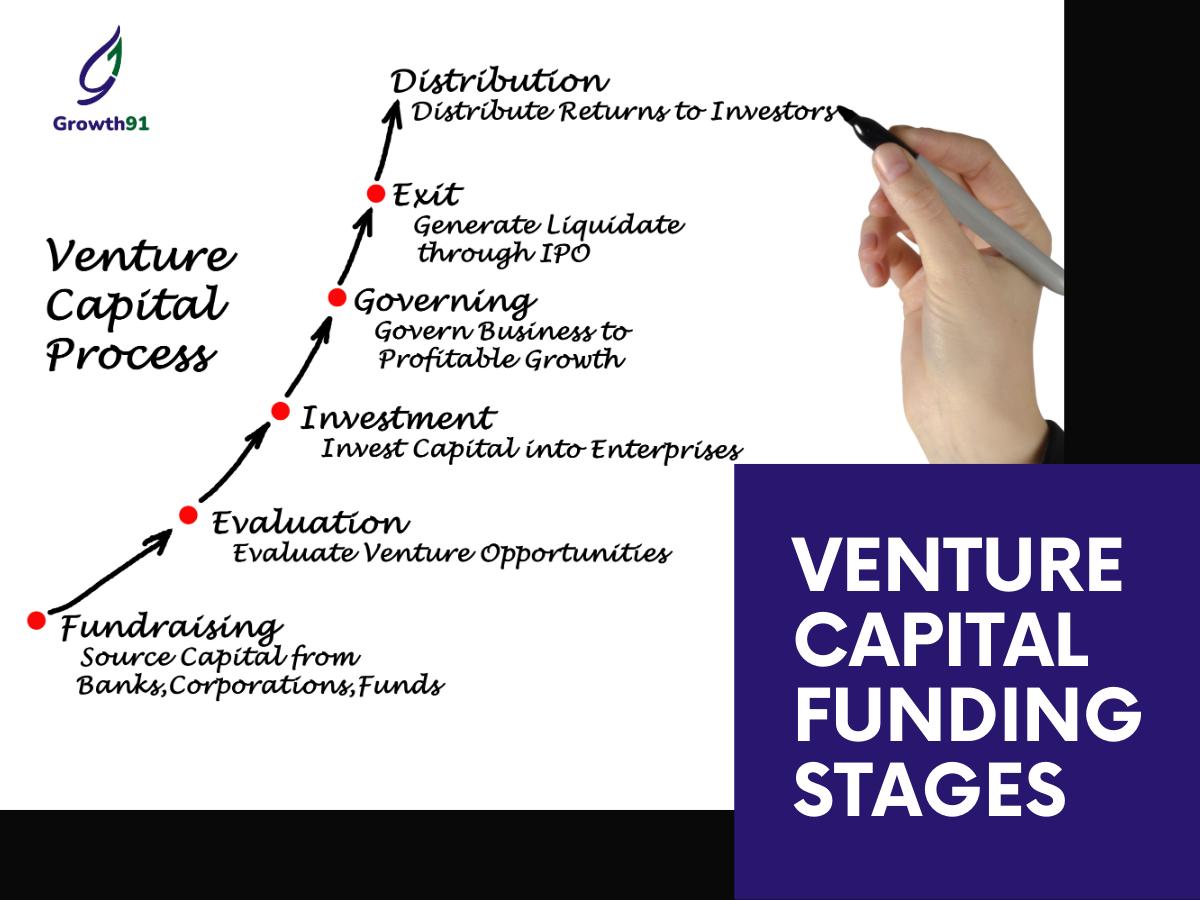

In the vibrant landscape of Indian startups, venture capital funding has become a cornerstone for ambitious entrepreneurs aiming to scale their ideas. Whether you’re a first-time investor or a seasoned one, understanding the journey startups undertake in venture capital funding can provide valuable insights. This article breaks down the typical stages of venture capital funding for startups in India, tailored to help investors like you make well-informed decisions.

What is Venture Capital Funding?

Venture capital (VC) funding is a form of private equity financing where investors provide capital to startups or small businesses that have high growth potential. Unlike traditional bank loans, venture capital funding involves investors owning a stake in the startup, aligning their success with the company’s growth.

Why Do Startups Need Venture Capital?

Startups often lack the collateral, credit history, or consistent cash flow needed to secure loans. Venture capital bridges this gap by offering financial support, industry insights, and networking opportunities. It’s like having a partner who not only shares the financial burden but also provides strategic guidance for scaling up.

Stage 1: Pre-Seed Funding

Pre-seed funding is the earliest stage, where the idea is still raw, and the startup is in its formative phase. This stage typically involves funds from family, friends, or angel investors who believe in the founder’s vision. Investments are usually modest, covering early expenses like market research, product development, or setting up a team.

Investor Insights:

Investing at this stage can be a high-risk, high-reward scenario. It requires a strong belief in the founder’s potential since there’s usually little to no product traction yet. However, successful early-stage investments can yield substantial returns as the startup grows.

Stage 2: Seed Funding

The seed stage is the foundation of a startup’s growth journey. With a Minimum Viable Product (MVP) and initial user feedback, founders seek funds to enhance their offerings and conduct more in-depth market validation.

Investor Insights:

Seed-stage investments are popular with angel investors and early-stage VC firms who want to secure an early stake. Although the risk is still high, the startup now has a clearer roadmap and an MVP, making it easier for investors to evaluate its potential.

Stage 3: Series A Funding

By Series A, a startup generally has a growing customer base, proven product-market fit, and measurable revenue streams. The focus now shifts to scaling operations, marketing, and team expansion.

Investor Insights:

Series A investors expect solid business metrics. While the risks are relatively lower than in previous stages, significant growth potential remains. Typically, VC firms specializing in growth-stage investments participate at this level.

Stage 4: Series B Funding

In Series B, startups have successfully scaled operations and established a robust business model. The focus here is on optimizing operations, expanding into new markets, and solidifying brand presence.

Investor Insights:

Investing in Series B funding attracts investors who prefer stable returns over quick, risky gains. At this stage, startups have predictable revenue streams, allowing investors to assess scalability and profit potential with greater clarity.

Stage 5: Series C Funding and Beyond

Series C and later stages are for startups that are highly successful and looking to go international, launch new product lines, or prepare for an IPO. Investors at this stage can expect lower risk but also relatively stable returns.

Investor Insights:

Series C and beyond are generally the domain of institutional investors, hedge funds, and banks. Startups are financially stable, making these stages suitable for investors seeking lower-risk profiles and steadier returns.

Why Investors are Attracted to Each Stage

Each funding stage offers a unique risk-reward profile. Early-stage investors seek high returns by betting on promising ideas, while later-stage investors prioritize financial stability and predictable returns. The journey through these stages is like watching a seed grow into a towering tree, with each phase offering opportunities for investment growth and reward.

How to Choose the Right Stage for Investment

Choosing the right stage to invest in depends on factors such as risk tolerance, capital availability, and investment goals. If you’re inclined towards high-growth opportunities and can withstand the risk, early-stage investments might be more suitable. For those seeking stability and a lower risk, later stages can provide a safer yet profitable avenue.

The Role of a Startup Investing Platform in India

In India, startup investing platforms are crucial in bridging the gap between investors and high-potential startups. These platforms vet startups, providing investors with valuable data, insights, and connections. For new investors, platforms like these make it easier to find and evaluate startups at various funding stages, streamlining the investment journey.

Growth91: Your Gateway to Indian Startups

Growth91 offers a comprehensive platform for those looking to invest in startups and support India’s entrepreneurial landscape. As a startup investing platform for investors, Growth91 provides resources, verified startup profiles, and insights that make it easier to find investment-worthy opportunities across all funding stages. With Growth91, you can confidently explore ways to invest in the Indian startup ecosystem and join the journey of India’s most promising startups.

Conclusion

Understanding the stages of venture capital funding in India is essential for making informed investment decisions. Whether you’re investing in an idea just taking shape or a mature business ready to scale, each stage offers unique opportunities and challenges. Venture capital funding is more than just financial backing; it’s about supporting innovation, creating jobs, and shaping the future. Growth91 is here to guide investors through the process, empowering them to invest in Indian startups that are shaping tomorrow.

Leave a Reply